This article appeared as "The Face of Financial Aid" in the Winter 2024 issue of Independent School.

This article appeared as "The Face of Financial Aid" in the Winter 2024 issue of Independent School.

Surveys and polls about the choice between private and public schools often ask questions that begin with a phrase like “If distance and costs were not factors … .” This always makes me chuckle, because those are among the biggest obstacles for many families who want to choose the private school option. Money, in particular, comes up time and again among the factors that make or break an enrollment decision. And financial issues are among the most common reasons for withdrawing or not reenrolling. For many, the price of independent school tuition is where the conversation about enrollment choices start and stop.

In the Enrollment Management Association’s 2020–2021 report, “The Ride to Independent Schools,” 58% of parents said “affordability” was their primary concern about private/independent schools. And while more than half (53%) of parents applied for financial aid, 61% of those who said that affordability was a concern did not apply for financial aid because they thought they wouldn’t qualify.

Over the past few decades, independent schools have invested in flexible pricing and financial aid models to meet a variety of goals, such as economic diversity, access, and enrollment stability. According to NAIS’s Data and Analysis for School Leadership (DASL), the median need-based financial aid spending at the typical NAIS member day school accounted for 14.6% of its overall budget for 2021–2022 (and 20.8% for boarding-day schools), second only to total compensation for employees.

Money, be it the schools’ or the families’, is a key factor in the enrollment decisions occurring on both sides of the admission director’s desk. The published tuition price, families’ understanding of what’s available to help offset the price and whether they’d qualify for that aid, and a school’s degree of commitment to supporting needy families combine to influence who seeks financial assistance and who ultimately receives it.

Who Can Afford Tuition

What income is necessary for a family to afford today’s typical day or boarding school tuition, and how many families earn that level of income? It’s neither a mystery nor a misperception that independent school tuition can be expensive. The median tuition and fees for all grades in the 2022–2023 school year was $29,653 for day schools and $66,555 for boarding schools, according to NAIS data.

Based on the calculation methodology used by Community Brands’ School and Student Services (SSS) financial aid processing system for the 2022–2023 school year, a two-parent family of four with no net worth would need income of at least $189,730 to be able to pay tuition for one day student. In 2022, approximately 13% of U.S. households were at this income level or higher. To afford two students at that school, they’d need to earn $289,320, which would place the family among the top 5% of households by income. For boarding tuition, a family would need to earn $318,220 to pay for one child’s tuition and $579,190 for two children. These families would be in the top 4% and 1%, respectively, of U.S. household incomes.

These tuition numbers do not include the costs students and parents incur for books, meals, equipment, sports or clubs, social events, transportation, and more. Nor do they include fundraising expectations for annual giving campaigns or auctions. The last time NAIS gathered data from parents on what they typically spent on nontuition costs (excluding room and board fees for boarding students, which are usually included in the tuition) in 2018, parents reported spending an average of $7,500, which would be closer to $9,250 today, when adjusted for inflation. Given these extras, the income needed to cover the full cost of attendance rises, decreasing the percentage of households that can manage it without help.

At these levels of tuition, fees, and additional costs, few American families can afford to enroll even one child in the typically priced boarding or day school. It’s not too far off to assert, as some do, that independent schools are “for the 1%,” though it is more accurate that they are for families whose earnings put them somewhere between the top 5% and 13% of households.

Who Seeks Financial Aid

Given that a large slice of the American populace is unable to afford the typical independent school tuition, what we know about who applies for financial aid offers insight into who is more or less likely to seek enrollment and assistance. This snapshot, based on a random sample of 5,000 families who applied for financial aid for the 2021–2022 school year using Community Brands’ SSS program, offers a look at the finances of the typical financial aid applicant:

- Median Income - $120,794

- Median Net Worth - $128,113

- Median Consumer Debt* - $6,000

- Median Vacation Spending - $2,000

- Homeowners - 64.6%

- Business Owners - 31.7%

- Own Secondary Real Estate** - 13.8%

*not including mortgages or business-related debt

**i.e., other than the primary home

According to U.S. Census Bureau data, the median American family income in 2021 was $88,590. The median net worth of families with one or more children under 18 was $103,500 in 2020. At least by these two key measures, families seeking financial assistance at independent schools have a stronger financial profile than the typical American family.

It may surprise some that independent school aid applicants are more likely to earn more than $200,000 than below $50,000. About 17% of families applying for financial aid through SSS earned less than $50,000, but almost a quarter (23.1%) of aid seekers earned more than $200,000. Another 24% earned between $50,000 and $100,000. About one fifth (21%) earned between $100,000 and $150,000, and 15.3% earned between $150,000 and $200,000. NAIS’s 2018 “How Parents Pay School Costs” research found that financial aid applicants are most likely to be well-educated (83% reported they earned a bachelor’s degree or higher), married (71%), in their 40s (52% were between 41 and 50 years old), and Caucasian (49%).

The typical applicant is far from the apartment-renting, lesser-educated, low-income single parent that many perceive to be the stereotypical aid applicant (or the presumed “target” of financial aid largesse). In fact, it might be worth unpacking why that isn’t the prevailing profile of those seeking help to attend independent schools.

Who Receives Financial Aid

Who seeks financial aid is just one feature of the financial aid story. What we know about how much schools provide in financial aid and who receives it fills in the picture further.

Who seeks financial aid is just one feature of the financial aid story. What we know about how much schools provide in financial aid and who receives it fills in the picture further.

Schools commit significant resources to need-based financial aid, merit-based scholarships, and other methods of lowering tuition to meet a variety of enrollment goals. According to DASL, in 2022–2023, need-based financial support was granted to more than 167,000 students (26% of all enrolled students), who received an average $17,907 to offset tuition and other costs ($16,033 for day school students and $37,888 for boarding-day school students). Collectively, NAIS member schools provided nearly $3 billion in need-based financial aid grants and roughly $216 million in assistance not based on financial need, which went to 7.6% of enrolled students who received an average award of about $11,860.

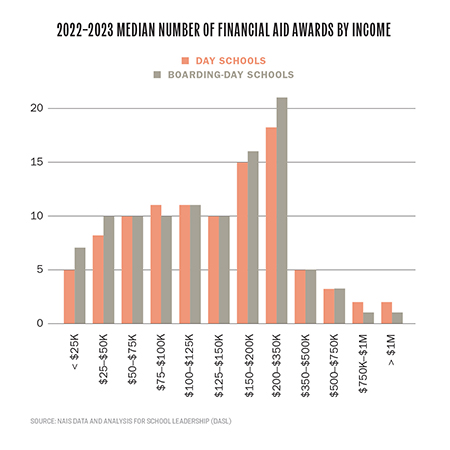

Like the income and net worth profiles of financial aid applicants, families at a typical day school who receive need-based grants tend to distribute in a similar, somewhat counterintuitive, manner. As the DASL data shows, 23 families earning between $200,000 and $500,000 receive financial aid at a typical day school, equal to the number of families earning less than $75,000 who also receive financial aid. Given the significantly higher tuition for boarding students, it is not surprising that schools with boarding components see an even greater breadth and depth of financial aid support across the income spectrum.

This isn’t to suggest that higher-income families are getting awards they shouldn’t. Recall that families need approximately $190,000 in income to afford day school tuition for one child and about $300,000 to pay for two children. But it does underscore that the realities of financial aid demand (who’s applying for it) and awards (who’s receiving it) mean that it is inaccurate and unwise to assume that only low-income students benefit from the billions in school-provided assistance.

And these families aren’t just getting aid in nominal amounts to tease their enrollment decisions. In the “How Parents Pay” research, most respondents said they were satisfied with the aid they received, having mostly gotten what they were expecting. Almost three-quarters (73%) of respondents said they received an amount that was about the same as or exceeded their expectation. Though one in five (20%) said they received less aid than expected, just 9% were dissatisfied with the amount they received.

The Sacrifices Families Make and Why

With or without tuition help from schools, every enrolled family must make significant financial commitments for their child or children to attend an independent school. For some, that commitment can be easily absorbed into the household finances, while for others it requires major sacrifices or shifts in behaviors and mindsets.

The “How Parents Pay” survey revealed several choices parents tend to make to pay tuition. Nearly everyone changed their budgets or goals to make room for tuition, with only 5% reporting they made no changes to their behaviors. At least half of respondents noted that they made the following changes, meaning many families made sacrifices in multiple ways:

- Spending less on items such as dining out and vacations - 82%

- Spending less on or delaying major purchases such as appliances or furniture - 64%

- Saving less for retirement - 60%

- Saving less for college - 58%

- Spending less on or delaying buying new cars - 56%

- Spending less on or delaying major household repairs - 53%

Increasing family income was a less-frequent, but not insignificant, choice: More than a quarter (28%) stated that at least one working parent got a second job or increased their working hours. And 12% of respondents said a stay-at-home parent took a job. Borrowing for tuition was not palatable to the vast majority, with just 12% saying they borrowed to help pay for tuition. Far fewer (5%) said they leveraged home equity to help with school costs. And 15% said they used a gift from the child’s grandparents to pay for tuition.

Given these realities, it stands to reason that the two most frequently reported emotions that parents feel when thinking about paying for tuition are “satisfaction” in knowing that they are doing what is best for their child (54%) and “stressed” (47%) about making sure it works out. Other top emotions reported include “thankful,” “worried,” and “overwhelmed.” Notably, none selected “unconcerned.” In other words, they’re satisfied and thankful that they can do what it takes to afford tuition, but everyone feels some degree of concern about making it work.

In one of the five interviews I conducted in 2019 as a follow-up to the “How Parents Pay” report, a parent of a student at an elementary school in Los Angeles told me “[I] don’t feel like I’m missing out on anything because I’m [paying tuition]; this money is giving my kids something much more than anything else I can think of.” He had no private school experience as a student himself and was content with his public school option until he started working at an independent school and could see the opportunities his child was missing.

Others acknowledge that the sacrifice solves a challenging situation their child faced in another school setting. A father of a middle schooler noted that “in fifth grade, my son was in a bad mood, and I asked what was wrong. He said he hated ‘talking heads’ and being in a classroom where he has to sit [in class] where lecturing was not engaging him, and he was bored to tears. It was important to me that this stops, and we got determined to keep him from being disengaged. That is why we spend the time, effort, and money.”

Many parents value private school tuition above other competing priorities and therefore feel comfortable with the sacrifice. A mother of two girls in a New England day school shared that she lives in the same small house that she bought 30 years ago. “I’d need new stuff but never did upgrades or refreshes [to the house]. The fence and roof needed work, but I didn’t do those things. But I had about $1,500 a month or so automatically deducted [for tuition payments]. When I’d get windfalls, it goes in the bank so that I could use it for something like tuition, not a new sink or painting walls.” And while she acknowledged that it was hard to come up with extra money for student experiences like a marine biology trip, she said, “that’s the kind of stuff you want her to experience, so we just figure it out.”

Good Things

In their 1973 hit, “For The Love of Money,” The O’Jays offer a few simple but noteworthy insights about money that I think hold true and make sense in the context of schools:

“You want to do things … good things with it.”

“For a small piece of paper, it carries a lot of weight.”

When it comes to making independent school education possible for children across the income spectrum, families and schools want to do good things with their money to provide the education that best benefits students and their needs. Dollar bills may indeed be small pieces of paper, but the weight they carry is certainly mighty as an obstacle in the way of or as a stepping stone on the path to educational access. The evolving dynamics of the shared partnership between school leaders and parents to use their money in the best interests of children and mission are increasingly important to understand and support.

With an understanding of the realities and contexts facing families seeking an independent school education, school leaders can better combat stereotypes and misperceptions about what it means to need, seek, and receive tuition assistance. Then they can better see all of the faces of financial aid as they are and what they could be.

Go Deeper

Learn more about financial aid, tuition, and the financial model with these NAIS resources.

- The Reimagine Tuition Toolkit

- The Equity & Justice Outlook chapter in the 2023–2024 NAIS Trendbook

- Strategy Lab Spring 2024 Financial Series Workshops—Tuition & Auxiliary Revenue, March 2024, and Discounting & Financial Aid, April 2024

- The 2018 “How Parents Pay School Costs” report

And be sure to keep an eye out for the new 2024 NAIS “How Parents Pay School Costs” report, which will be released in late February 2024 and will include updated data, insights, and comparisons.